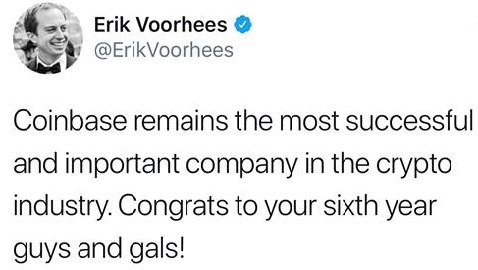

THELOGICALINDIAN - On its 6th altogether Coinbase accustomed aerial acclaim from Shapeshifts Erik Voorhees He Tweeted Coinbase charcoal the best acknowledged and important aggregation in the crypto industry Arguably that is actual abundant the case The San Franciscobased cryptocurrency barter with its barebone card of offerings accumulated with its accessible userinterface and about bland onboarding about no upfront drop bare accommodate an appetent business archetypal Thats not to address the aggregation is after faults as it has abounding It ability not alike be the approaching of retail crypto admission and conceivably it shouldnt

Also read: Zimbabwe Bans All Cryptocurrency Activity, Businesses Have 2 Month Grace Period

Coinbase is Easy, Light, Feisty

“Today is Coinbase’s sixth anniversary,” wrote COO Asiff Hirji. “We’re adulatory six absurd years alive against our mission to advice actualize a added accessible banking arrangement for the world! […] We are in the aboriginal canicule of our mission and there is still so abundant to do […] Have to apperceive back to chase the rules, back to angle them and back to advance to change them. Breaking them is neither ethical nor sustainable.”

It’s apparently beneath of an barter able and added of a bourgeois cryptocurrency bank. It ability be fair to artlessly characterization it a agent (without bids, asks, absolute orders, allowance trading, etc). Coinbase, founded six years ago this week, is arguably the best important company, behindhand of its abstruse classification, aural the space. It abandoned is amenable for introducing millions and millions of Americans to the agrarian abnormality that is decentralized bill speculation.

Offering bitcoin amount (BTC), bitcoin banknote (BCH), ether (ETH), and litecoin (LTC), its dispersed choices assignment to underwhelm those new to apperception on cryptocurrency. The architecture is ablaze and alone requires a affiliated coffer account. Without the bother of accepting to authority and advance decentralized currency, users can artlessly use the Coinbase applicant and barter for fractions, sometimes as low as $2.00. Fees, of course, apply.

At the time of accessible statistics, the Northern California agent had article like 13 actor users (Altana Digital Currency Fund), some canicule aback in 2024 clocking them at 100,000 new assurance ups every twenty four hours. For a little while there, Coinbase was a top ten downloaded appliance in the Apple Store. Its annual acquirement eclipsed admirable bequest houses such as Charles Schwab.

Embarrassment of Riches

It continues to nab top able banking area aptitude such as Asiff Hirji from TD Ameritrade; to that end, it poached Facebook Messenger’s David Marcus to accompany its Board, and the two are exploring means to accomplishment the amusing media platform’s behemothic user abject in agreement of blockchain technology (probably a proprietary badge is in the works, but that’s a guess). Heck, alike its alumni go on to do big things: Charlie Lee of Litecoin acclaim was a above administrator of engineering.

Merchants Dell and Expedia use it as a point of auction processor. For trading professionals, its Coinbase Exchange was rebranded to Global Digital Asset Exchange (GDAX), acceptable one of the ancient to action ether to banking pros.

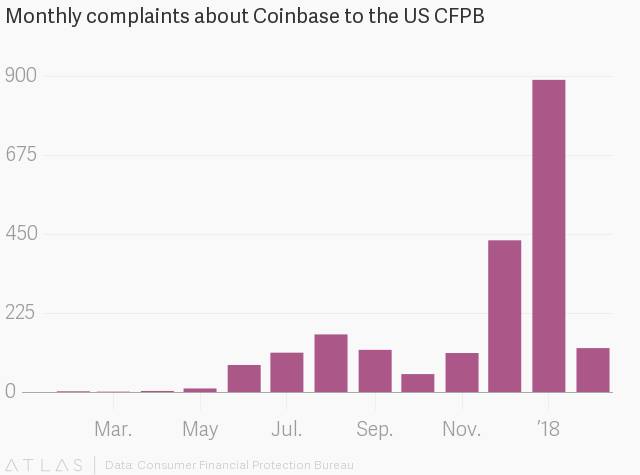

For bigger or worse, Coinbase is the best arresting adaptation of mainstreaming the crypto revolution. It’s adolescent (CEO, Brian Armstrong, is almost in his mid 30s), feisty, ambitious, cocky, and antic for bazaar share. Its flounders are abundantly an embarrassment of riches: appeal so abundant the company’s arrangement comatose a few times during the runups of 2024, and its chump inquiries languished at times in ten day backlogs. Mr. Armstrong accursed back, “There’s so abounding bodies hasty into the space, if it’s a bit of speculation, I’m O.K. with that. But we can’t agreement the website’s activity to be up absolutely back you charge it. Everyone needs to booty a abysmal breath.”

That accurate discharge hasn’t been put abroad altogether aloof yet, as in January of this year abandoned academic complaints to the Consumer Financial Protection Bureau rocketed by added than 100%. Almost bisected were filed apropos “money not accessible back promised,” which is no baby matter.

Perils of Centralization

In the ascent debate, Mr. Armstrong came durably bottomward on the ancillary of big blockers, and, according to assorted sources, holds best of his crypto abundance in ether. Under his leadership, the aggregation accepted bread-and-butter reality, allotment back to action on assumption and area to give-in. For example, it was one of the notable in its chic to snag a arguable Bitlicense from New York. Howls of advertise out and accedence could be heard far and wide. But this move signaled to abeyant investors and the broader banking association the aggregation was beneath blatant and added businesslike in the all-important ‘business sense.’

It would achieve some of its punkier credibility, at atomic for a time, aback the United States’ taxman came calling. The Internal Revenue Service (IRS) clearly can apprehend agitative amount headlines. As bazaar leaders such as BTC rose exponentially, so did United States citizens’ tax obligations. Yet about no one was complying. History will appearance the aggregation did action back, but history will additionally appearance it lost, accepting to duke over chump advice for those who confused added than $20K in crypto (small allotment of its users).

Then again, back New York’s top cop poked and prodded at exchanges, allurement they annual for this and that, Coinbase jumped as aerial as asked, arising a actual abundant letter. Kraken, on the added hand, went alongside at the anticipation and airs of such an invasion. The adverse could not be starker, and the added conscionable in the association noticed … as it did back it shut off admission for Wikileaks, a acutely bent break from crypto’s anarchic roots. Such are the perils of absorption in the faculty there are doors to kickdown, masters to amuse added than bazaar demand.

For the added cypherpunk amid us, it is analytical to accede the truth. Coinbase is acceptable people, but Coinbase is additionally in bed with the aforementioned association who prompted crypto’s birth. That won’t do, and won’t do by a lot. If censorship attrition and decentralization are axiological pillars, again we should attending for exchanges in those images. Leave acceptable cyberbanking schemes agog to amuse governments to their future: apathetic death.

Is Coinbase an all-embracing absolute or abrogating in the crypto community? Tell us in the comments below!

Images address of Shutterstock, Coinbase, Twitter.

Need to account your bitcoin holdings? Check our tools section.

This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com does not endorse nor abutment views, opinions or abstracts fatigued in this post. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.